Global Anti-Money Laundering (AML) Training

Help your employees identify, prevent and report suspicious activities to protect your organization from financial and reputational damage.

Course description

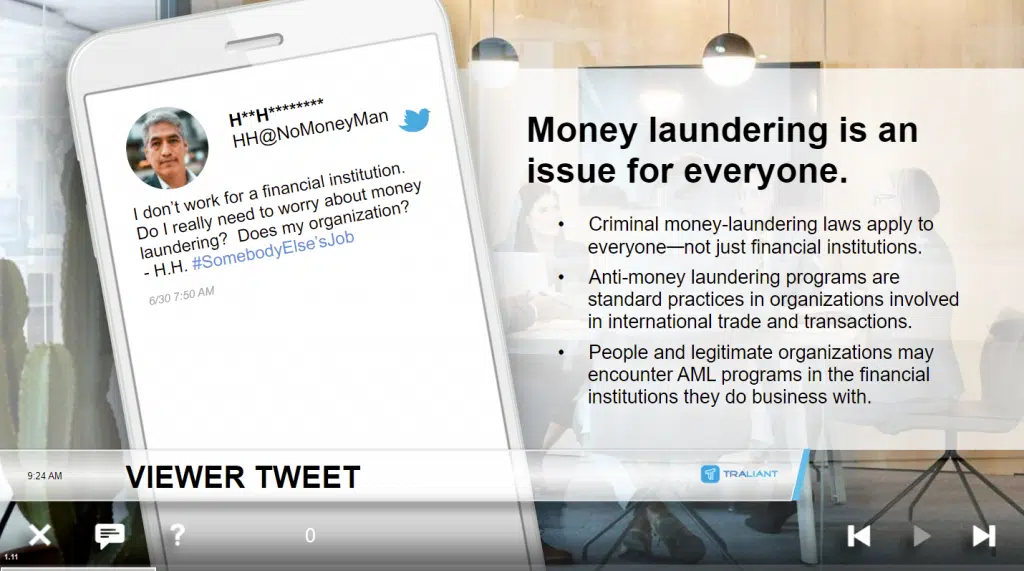

This 35-minute course introduces employees and managers to the basics of global anti-money laundering. This course highlights common money laundering schemes, along with strategies for detecting, preventing and reporting suspicious activities. A variety of eLearning challenges reinforce AML concepts and boost engagement and knowledge retention.

ONLINE TRAINING

Global Anti-Money Laundering (AML) Online Training Course

This course covers these topics and more:

- What is money laundering?

- The 3 stages of money laundering

- Key players in the US, UK, EU and International

- Overview of key AML laws

- Know Your Customer (KYC) procedures

- Spotting potential problems and red flags

- Taking action

THE TRALIANT DIFFERENCE

Compliance you can trust.

Training you will love.

Legal expertise

Our in-house legal team monitors the latest laws, rules and regulations, so you don't have to. You can rest assured that our courses are continuously compliant.

Brilliant training

Take your training from boring to brilliant. With cinematic-quality videos produced by our Hollywood-based team, your employees will love our customizable, interactive, story-based training.

Valued partnership

Our main focus? It’s all about making your job easier. We do that with unmatched responsiveness and seamless deployment, dedicated to driving your success.

Meaningful impact

We don’t just deliver brilliant training, we help you create meaningful impact by broadening your employees' perspectives, achieving compliance and elevating culture.

KEY FEATURES

Why you'll love our training

It’s time to embrace a new era of online training with a valued partner who will ensure seamless implementation, a truly enjoyable learning experience, and courses with continuous compliance you can trust.”

Compliance expertise

Traliant's in-house legal expertise ensures training is accurate and kept up-to-date with any regulatory changes.

Accessible to users with disabilities

Traliant provides an inclusive experience for all users, including those with disabilities, by going beyond Section 508-C standards and offering WCAG 2.1/2.2 AA.

Story-based learning

Our story-based approach blends leading instructional design with Hollywood talent to produce engaging, interactive and nuanced training.

Course administration

Traliant makes it simple to roll out training to your workplace and provide technical support directly to your employees at no additional cost.

Course customizations

Tailor courses to include your logo, relevant policies, workplace images, and more. Traliant can even customize the course with scenarios that take place in your own workplace environment.

Translations

Training is available in English, Spanish and is supported in over 100 languages.

COMPLIANCE EXPERTISE

Your partner in training compliance

Uniquely qualified in-house compliance team

Our exceptional in-house Compliance Advisory Team is led by Michael Johnson, Chief Strategy Officer and former U.S. Department of Justice attorney who has provided training and guidance to organizations like the Equal Employment Opportunity Commission, Google, the United Nations, and the World Bank.

Keeping you compliant, effortlessly

Keeping up with the complex web of employment laws — especially if your workforce spans multiple states — can be tricky. That’s why we offer a streamlined training solution that ensures you stay compliant with federal, state, and local regulations, so you can focus on what matters most: your team.

Simplifying your policies and handbooks

Crafting an employee handbook that meets legal standards can be daunting. Let us ease the burden. We help you navigate regulatory changes to ensure your policies and handbooks not only comply with the law but also reflect industry best practices.

What to consider when choosing the most effective Anti-Money Laundering training

- Minimize legal and financial risks: Money laundering carries with it severe penalties for both individuals and organizations. Training helps to protect your company from legal and financial repercussions.

- Maintain a positive reputation and build trust: Being associated with money laundering can damage a company's reputation and erode trust with customers, investors, and other stakeholders.

- Create a culture of compliance and ethical conduct: Training helps to promote a culture where employees understand the importance of following AML regulations and reporting suspicious activity.

- Equip employees with the knowledge to act: Training provides employees with the necessary knowledge to identify and report suspicious activity, which can help to prevent money laundering schemes.

- Strengthen your compliance program: A robust AML compliance program is essential for any organization. Training is a key component of ensuring that your company meets its compliance obligations.

- Foster a strong culture of ethics and integrity: Training helps to promote a culture where employees understand that ethical conduct and compliance are paramount.

- Frequency of money-laundering training: Ongoing anti-money laundering (AML) training is essential. Given the severe penalties associated with AML violations, many organizations prioritize this training. As AML risks can arise anywhere within a company, we strongly recommend implementing regular training for all employees to mitigate these risks and ensure compliance.

- Organizations required to provide money-laundering training: Financial institutions subject to the US Patriot Act or Bank Secrecy Act are required to cover employees, typically those involved in any financial transaction, within a reasonable time of on-boarding and on an approximate annual cadence.

- International laws related to money-laundering training: Additionally, international laws also include employee training, including:

- UK Money Laundering, Terrorist Financing and Transfer of Funds Regulation

- Canada: Proceeds of Crime (Money Laundering) and Terrorist Financing Act

- Australia: Anti-Money Laundering and Counter-Terrorism Financing Act 2006

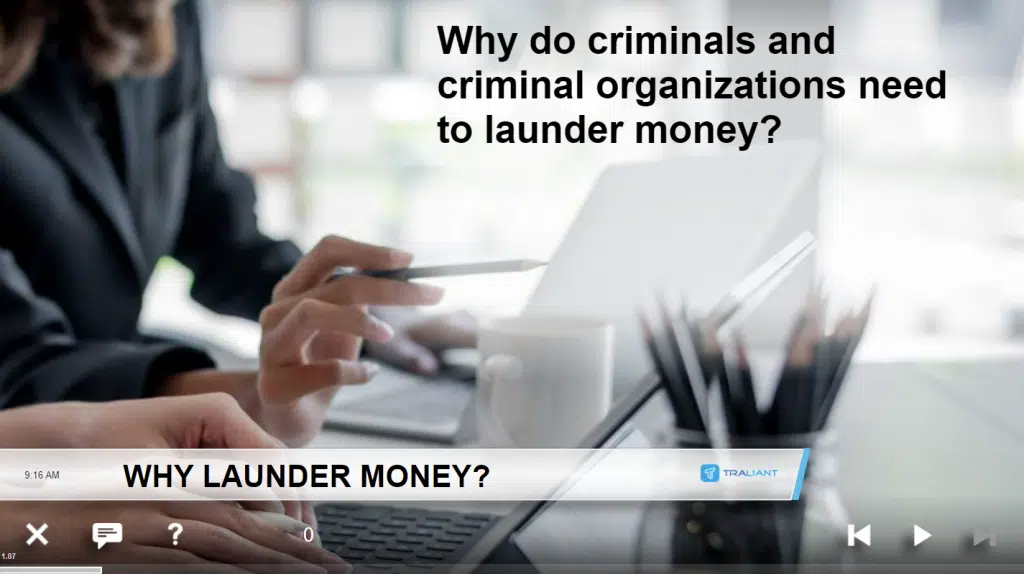

- Placement: The initial stage, where the illegally obtained funds are introduced into the financial system.

- Layering: Complex transactions are used to obscure the source of the funds and make them harder to trace.

- Integration: The final stage, where the laundered funds are integrated into the legitimate economy and used for criminal activities.

- Identifying high-risk customers: KYC processes can help to identify individuals or entities who may be involved in money laundering.

- Monitoring customer transactions: KYC procedures help organizations to monitor their customers' transactions and to identify any suspicious activity.