Payment Card Information Data Security Standards (PCI DSS)

If you accept credit, debit and prepaid cards, you must comply with the PCI DSS or risk costly fines, losing insurance coverage or forfeiting the ability to accept payment cards

Course description

Traliant’s Payment Card Industry Data Security Standards (PCI DSS) training is a 15-minute course designed to equip your employees with essential knowledge about PCI DSS 4.0. The course introduces them to the 12 key standards for protecting cardholder data and ensuring compliance. Through engaging, realistic scenarios and interactive exercises, employees will learn to identify potential payment card fraud, understand the steps to prevent it and help ensure the security of payment card transactions.

ONLINE TRAINING

Payment Card Information Data Security Standards (PCI DSS)

The course covers these topics and more:

- What data is covered by PCI DSS

- The 12 goals of PCI DSS 4.0

- Organizational policies and procedures

- Reporting misconduct, suspicion of fraud, or security breaches

- Safeguards and security including multi-factor authentication and using anti-malware software

- Checking payment terminals

- Identifying and halting fraud including payment card skimming

THE TRALIANT DIFFERENCE

Compliance you can trust.

Training you will love.

Legal expertise

Our in-house legal team monitors the latest laws, rules and regulations, so you don't have to. You can rest assured that our courses are continuously compliant.

Brilliant training

With cinematic-quality videos produced by our Hollywood-based team, your employees will love our customizable, interactive, story-based training.

Valued partnership

Our main focus? It’s all about making your job easier. We do that with unmatched responsiveness and seamless deployment, dedicated to driving your success.

Meaningful impact

We don’t just deliver brilliant training, we help you create meaningful impact by broadening your employees' perspectives, achieving compliance and elevating culture.

KEY FEATURES

Why you'll love our training

It’s time to embrace a new era of online training with a valued partner who will ensure seamless implementation to fit your exact, a truly enjoyable learning experience and courses with continuous compliance you can trust.

Compliance expertise

Traliant's in-hour legal expertise ensures training is accurate and kept up-to-date with any regulatory changes.

Accessible to users with disabilities

Traliant provides an inclusive experience for all users, including those with disabilities, by going beyond Section 508-C standards and offering WCAG 2.1 AA.

Story-based learning

Our story-based approach blends leading instructional design with Hollywood talent to produce engaging, interactive and nuanced training.

Course administration

Traliant makes it simple to roll out training to your workplace and provide technical support directly to your employees at no additional cost.

Course customizations

Tailor courses to include your logo, relevant policies, workplace images, and more. Traliant can even customize the course with scenarios that take place in your own workplace environment.

Translations

Training is available in English, Spanish and is supported in over 100 languages.

COMPLIANCE EXPERTISE

Your partner in training compliance

Uniquely qualified in-house compliance team

Our exceptional in-house Compliance Advisory Team is led by Michael Johnson, Chief Strategy Officer and former U.S. Department of Justice attorney who has provided training and guidance to organizations like the Equal Employment Opportunity Commission, Google, the United Nations, and the World Bank.

Keeping you compliant, effortlessly

Keeping up with the complex web of employment laws — especially if your workforce spans multiple states — can be tricky. That’s why we offer a streamlined training solution that ensures you stay compliant with federal, state, and local regulations, so you can focus on what matters most: your team.

Simplifying your policies and handbooks

Crafting an employee handbook that meets legal standards can be daunting. Let us ease the burden. We help you navigate regulatory changes to ensure your policies and handbooks not only comply with the law but also reflect industry best practices.

What to consider when choosing the most effective Payment Card Industry Data Security Standards (PCI DSS) training

- Protect sensitive data: The PCI DSS is a set of security standards designed to protect cardholder data. Training helps to ensure that employees understand these standards and that they are following best practices for handling sensitive information.

- Reduce the risk of data breaches: Data breaches can be costly and damaging to an organization's reputation. Training can help to minimize the risk of data breaches by raising awareness of security threats and by teaching employees how to protect cardholder data.

- Comply with PCI DSS requirements: All organizations that handle payment card information are required to comply with the PCI DSS. Training helps organizations meet this requirement and avoid fines and penalties.

- Empower employees: Training provides employees with the knowledge and skills they need to protect cardholder data and to comply with PCI DSS requirements.

- Strengthen your organization's security posture: Training helps to build a strong security culture, making it more difficult for cybercriminals to succeed in stealing cardholder data.

- Reduce the risk of financial losses: Data breaches can result in significant financial losses for organizations. Training can help to minimize these risks.

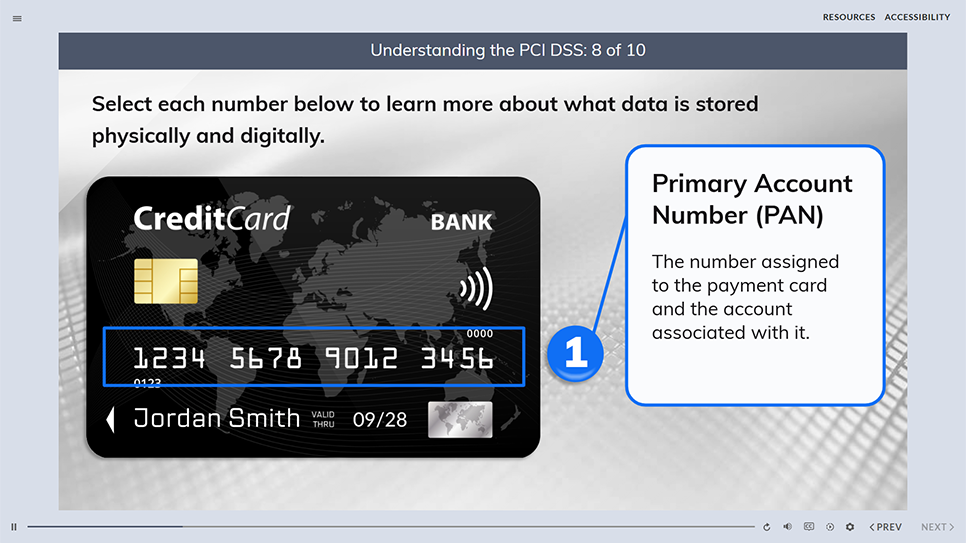

- Primary account number (PAN)

- Cardholder name

- Expiration date

- Service code

- Build and Maintain a Secure Network: Install and maintain a firewall configuration to protect cardholder data.

- Protect Cardholder Data: Do not use vendor-supplied defaults for system passwords and other security parameters.

- Protect Stored Cardholder Data: Encrypt transmission of cardholder data across open, public networks.

- Encrypt Transmission of Cardholder Data Across Open, Public Networks: Use strong cryptography and security protocols.

- Use and Regularly Update Anti-virus Software or Programs: Protect all systems against malware and regularly update anti-virus software.

- Develop and Maintain Secure Systems and Applications: Develop secure systems and applications and keep them up to date.

- Restrict Access to Cardholder Data: Limit access to cardholder data by business need-to-know.

- Identify and Authenticate Access to System Components: Assign a unique ID to each person with computer access.

- Restrict Physical Access to Cardholder Data: Restrict physical access to cardholder data.

- Track and Monitor All Access to Network Resources and Cardholder Data: Track and monitor all access to network resources and cardholder data.

- Regularly Test Security Systems and Processes: Regularly test security systems and processes.

- Maintain a Policy That Addresses Information Security for All Personnel: Maintain a policy that addresses information security for all personnel.

- Use strong passwords and multi-factor authentication: Strong passwords and multi-factor authentication add extra layers of security to accounts and devices that access cardholder data.

- Be cautious about phishing attacks: Be wary of emails, texts, or phone calls that ask for sensitive information.

- Securely store payment card information: Only store cardholder data that is absolutely necessary, and store it securely in a manner that complies with PCI DSS requirements.

- Regularly monitor for suspicious activity: Pay attention to unusual activity on accounts that handle cardholder data.

- Stay informed about security threats: Keep up-to-date on the latest cybersecurity threats and vulnerabilities.